Are you planning a trip and wondering which travel insurance policy is best for you? With so many options available, it can be overwhelming to choose the right one. But don’t worry, I’m here to help! In this article, we will discuss the topic in detail and guide you through the process of selecting the best travel insurance policy for your needs.

When it comes to choosing the best travel insurance policy, there are a few factors to consider. First, think about your travel destination and the activities you plan to engage in. If you are going to a remote location or participating in high-risk activities such as extreme sports, you would need a policy that covers medical emergencies and evacuation expenses. On the other hand, if you are traveling to a popular tourist destination with a well-developed healthcare system, you may not need as comprehensive coverage.

In addition to considering your destination and activities, it’s important to assess the coverage limits and benefits offered by different insurance policies. Look for policies that include coverage for trip cancellation or interruption, lost luggage, and medical expenses. It’s also essential to read the fine print and understand the exclusions and limitations of each policy. In the upcoming article, you will learn more about these factors in detail and get practical tips to help you choose the best travel insurance policy that gives you peace of mind during your trip. Stay tuned!

Choosing the Best Travel Insurance Policy

When it comes to planning your next vacation, it’s important to consider all aspects of your trip, including travel insurance. Travel insurance provides coverage for unexpected events that may occur during your trip, ensuring that you are financially protected and able to enjoy your vacation without worry. With so many travel insurance options available, it can be difficult to determine which policy is best suited for your needs. In this article, we will explore the different types of travel insurance, factors to consider when choosing a policy, how to compare policies, additional benefits and add-ons to look for, and common mistakes to avoid. By the end of this article, you will be equipped with the knowledge to choose the best travel insurance policy for your next adventure.

This image is property of i.ytimg.com.

What is Travel Insurance

Definition of Travel Insurance

Travel insurance is a type of insurance that provides coverage for various risks and unforeseen events that may occur while you are traveling. These risks can range from medical emergencies to trip cancellations, lost baggage, and more. By purchasing travel insurance, you are protecting yourself from financial losses that may result from these situations.

Importance of Travel Insurance

Travel insurance is an essential aspect of trip planning, as it provides you with peace of mind knowing that you are financially protected in case of any unforeseen circumstances. Whether it’s a medical emergency, trip cancellation, or lost baggage, travel insurance ensures that you will not be left with hefty expenses that can ruin your vacation. By investing in a travel insurance policy, you can enjoy your trip without worrying about potential financial burdens.

Types of Travel Insurance

Single Trip Insurance

Single trip insurance is designed to cover individuals or families for a single trip or vacation. This type of insurance provides coverage for emergencies and unexpected events that may occur during the trip. Single trip insurance is an ideal choice for individuals who travel occasionally or take one-time vacations.

Annual/Multi-Trip Insurance

Annual or multi-trip insurance provides coverage for multiple trips within a specific period. Instead of purchasing separate policies for each trip, annual insurance allows you to have continuous coverage for all your travels throughout the year. This type of insurance is ideal for frequent travelers and can save you time and money by avoiding the hassle of purchasing individual policies for each trip.

Medical Insurance

Medical insurance is crucial when traveling abroad, as it provides coverage for medical emergencies and necessary medical treatments. This type of insurance ensures that you have access to quality healthcare and helps to cover the costs associated with medical treatment, hospital stays, and even emergency medical evacuation if needed.

Cancellation Insurance

Cancellation insurance, also known as trip cancellation insurance, provides coverage for unexpected trip cancellations or interruptions. If you need to cancel your trip due to unforeseen circumstances such as illness, death in the family, or severe weather conditions, cancellation insurance can help you recover your prepaid expenses, such as flight tickets, accommodation, and tour bookings.

Baggage Insurance

Baggage insurance is designed to protect your personal belongings in case of lost, stolen, or damaged baggage during your trip. This insurance provides coverage for the cost of replacing or repairing your belongings, ensuring that you are not left with any financial burdens due to lost or damaged luggage.

Factors to Consider when Choosing Travel Insurance

Destination

The destination of your trip plays a significant role in determining which travel insurance policy is best for you. Different countries may have different healthcare systems, safety concerns, and levels of medical expenses. It is essential to choose a policy that provides adequate coverage for your specific destination and its associated risks.

Duration of Trip

The duration of your trip is another factor to consider when choosing travel insurance. If you are planning a short trip, a single trip insurance policy may be sufficient. However, if you are a frequent traveler or planning a longer trip, an annual/multi-trip insurance policy may be more cost-effective and convenient.

Coverage Limits

When comparing travel insurance policies, it’s important to review the coverage limits and ensure that they meet your needs. Consider the maximum coverage for medical expenses, trip cancellation, baggage loss, and other areas of coverage that are important to you. It’s crucial to choose a policy with coverage limits that align with the potential expenses you may face during your trip.

Exclusions and Limitations

It is vital to carefully review the exclusions and limitations of each travel insurance policy before making a decision. Exclusions are specific situations or events that are not covered by the policy, while limitations may outline specific conditions or requirements for coverage. Understanding these details will help you determine if the policy meets your needs and if there are any potential gaps in coverage.

Pre-Existing Medical Conditions

If you have pre-existing medical conditions, it’s important to consider how they will be covered by a travel insurance policy. Some policies may offer coverage for pre-existing conditions, while others may have exclusions or additional premiums. It’s crucial to disclose any pre-existing medical conditions and carefully review the policy’s coverage for these conditions.

Comparing Travel Insurance Policies

Insurance Provider Reputation

When choosing a travel insurance policy, it is essential to consider the reputation of the insurance provider. Research the company’s history, customer reviews, and ratings to ensure that they have a track record of providing reliable and efficient service. A reputable insurance provider will be there to support you in case of any emergencies or claims during your trip.

Coverage Options

Different travel insurance policies offer various coverage options. It’s important to evaluate your specific needs and requirements to ensure that the policy you choose provides adequate coverage. Consider the areas of coverage that are essential to you, such as medical expenses, trip cancellation, baggage loss, and other potential risks you may encounter during your trip.

Premiums and Deductibles

When comparing travel insurance policies, it’s important to consider the premiums and deductibles associated with each policy. The premium is the amount you will pay for the policy, while the deductible is the amount you will need to pay before the insurance coverage kicks in. It’s important to strike a balance between reasonable premiums and deductibles that you can comfortably afford.

Customer Reviews and Ratings

Customer reviews and ratings can provide valuable insights into the overall customer satisfaction and experience with a particular travel insurance policy. Reading reviews from fellow travelers can help you understand the quality of service, support during emergencies, and the ease of making claims. Take into consideration the experiences of others when making your decision.

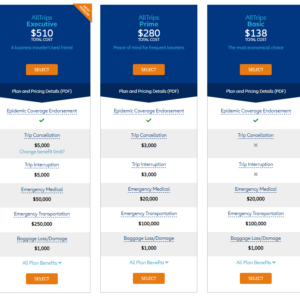

This image is property of thepointsguy.global.ssl.fastly.net.

Additional Benefits and Add-Ons

Emergency Assistance Services

Emergency assistance services are a valuable benefit to look for in a travel insurance policy. These services can provide 24/7 support in case of emergencies, such as medical emergencies, travel disruptions, or legal assistance. Having access to emergency assistance services can give you peace of mind knowing that help is just a phone call away.

Trip Cancellation Coverage

Trip cancellation coverage is a crucial benefit to consider, as it provides coverage for prepaid expenses in case you need to cancel your trip due to unforeseen circumstances. Whether it’s illness, death in the family, or other qualifying events, trip cancellation coverage ensures that you can recoup your non-refundable expenses and avoid financial losses.

Travel Delay Coverage

Travel delay coverage provides reimbursement for additional expenses incurred due to unexpected travel delays. If your flight is delayed for several hours or even overnight, travel delay coverage can help cover the costs of meals, accommodation, and transportation until you can resume your journey.

Baggage Delay Coverage

Baggage delay coverage offers compensation for essential items and expenses in case your baggage is delayed beyond a certain period. This benefit can help cover the costs of buying necessary clothing, toiletries, and other essential items while you wait for your luggage to be delivered.

Finding the Best Travel Insurance Policy

Evaluate Your Needs

The first step in finding the best travel insurance policy is to evaluate your specific needs and requirements. Consider the factors mentioned earlier, such as your destination, trip duration, coverage limits, and any pre-existing medical conditions. By understanding your needs, you can narrow down your options and choose a policy that aligns with your specific requirements.

Research Multiple Providers

To find the best travel insurance policy, it’s important to research and gather quotes from multiple providers. Compare the coverage options, premiums, deductibles, and additional benefits offered by each provider. This will give you a comprehensive view of the available options and help you make an informed decision.

Read Policy Terms and Conditions

Before making a decision, it’s crucial to thoroughly read and understand the policy terms and conditions. Pay close attention to exclusions, limitations, coverage details, and any additional requirements. If there are any clauses or provisions that you find unclear, don’t hesitate to reach out to the insurance provider for clarification.

Compare Quotes and Coverage

After researching multiple providers and reading the policy terms and conditions, compare the quotes and coverage options side by side. Consider the coverage benefits, coverage limits, premiums, deductibles, and any additional benefits or add-ons that may be offered. This comparison will help you identify the policy that offers the best value for your specific needs.

Ask for Recommendations

If you are unsure which travel insurance policy is best for you, don’t hesitate to ask for recommendations from friends, family, or fellow travelers. Hearing about others’ experiences and recommendations can provide valuable insights and help you make an informed decision. However, always remember to consider your own unique needs when making the final choice.

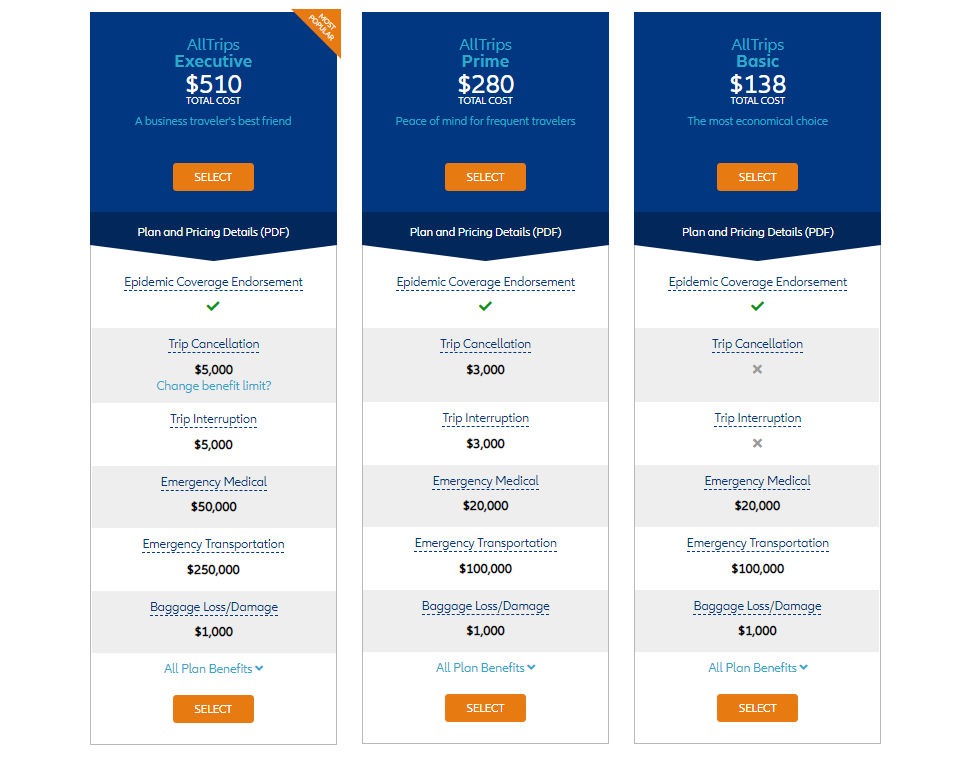

This image is property of thepointsguy.global.ssl.fastly.net.

Common Mistakes to Avoid

Not Reading the Fine Print

One common mistake to avoid when choosing a travel insurance policy is not thoroughly reading the fine print. The policy terms and conditions provide important details about coverage, exclusions, and limitations. Failing to read the fine print may result in unexpected surprises or gaps in coverage.

Underinsuring Yourself

Another common mistake is underinsuring yourself by choosing a policy with inadequate coverage. It’s essential to carefully assess your needs and ensure that the policy you choose provides sufficient coverage for potential risks and expenses. Underinsuring yourself can leave you vulnerable to significant financial burdens in case of emergencies.

Making Assumptions About Coverage

Assuming that certain events or situations are covered by a travel insurance policy without verifying the details can lead to disappointment and financial losses. Always read the policy terms and conditions and clarify any uncertainties with the insurance provider before making assumptions about coverage.

Not Disclosing Pre-Existing Conditions

If you have pre-existing medical conditions, it is crucial to disclose them when purchasing a travel insurance policy. Failing to disclose these conditions can result in denied claims or voided coverage. It’s important to be honest about your medical history to ensure that you are adequately covered for any potential medical emergencies during your trip.

Conclusion

Choosing the best travel insurance policy requires careful consideration of your specific needs, the coverage options provided, and the reputation of the insurance provider. By evaluating your needs, researching multiple providers, reading the policy terms and conditions, comparing quotes and coverage, and seeking recommendations, you can find the policy that offers the best value and protection for your next adventure. Remember to avoid common mistakes such as not reading the fine print, underinsuring yourself, making assumptions about coverage, and not disclosing pre-existing medical conditions. With the right travel insurance policy in place, you can enjoy your trip with the peace of mind that you are financially protected against unexpected events.